- this menu requires access rights assigned in the User Setup.

- this menu requires access rights assigned in the User Setup.

The Address menu allows for the printing and updating of address changes from the Department of Revenue. The address that the Department of Revenue provides is the address the debtor provided on their tax return. Account Code/Departmental controls - there are no account code/departmental controls.

Frequency: These processes can be run at anytime. However, once the Empty DOR Address Database is executed, it cannot be restored.

- this menu requires access rights assigned in the User Setup.

- this menu requires access rights assigned in the User Setup.

- Printing the Reconciliation Report at anytime will show all accumulated address changes. These reports should be shared with other departments that may have the debtor's old address.

- Printing the Reconciliation Report at anytime will show all accumulated address changes. These reports should be shared with other departments that may have the debtor's old address.

- there is no need to Apply DOR Addresses if the prompt to update after each setoff in set in System Settings.

- there is no need to Apply DOR Addresses if the prompt to update after each setoff in set in System Settings.

.- Apply DOR Addresses will overwrite the address in the software with that of the Department of Revenue, it is not selective by debtor. Empty DOR Address database can not be recovered.

.- Apply DOR Addresses will overwrite the address in the software with that of the Department of Revenue, it is not selective by debtor. Empty DOR Address database can not be recovered.

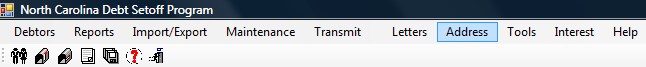

The Address menu:

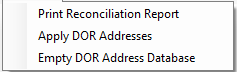

TheAddress menu options:

- Print Reconciliation Report (frequency: as needed, whenever setoffs have been imported) - prints a list of all accumulated address changes, for all account codes/departments, since the last time the Empty DOR Address Database option was executed.

- Apply DOR Addresses(frequency: whenever desired, can be done after each setoff) - will take all Department of Revenue address exceptions and update the addresses in the software.

- Empty DOR Address Database (frequency: whenever desired, can be done after time Apply DOR Addresses is executed) - purges all address exceptions from the Department of Revenue